Vacation Home Insurance: Get the Right Coverage for Your Second Home

You’ve fulfilled your dream of buying that picturesque second home, but how do you protect it from harm? Vacation home insurance. This type of insurance is not the same as traditional homeowners insurance, which is why you need to do your research before choosing a policy.

Where is your property located? Will you be using it as a short-term rental as well? These are just some of the questions you need to ask yourself to pick the right insurance policy to protect your vacation home.

Learn everything you need to know about vacation home insurance and how to pick the right policy for you in this article.

|

Key takeaways:

|

Protect your business from costly damages with Safely’s short-term rental insurance.

What is vacation home insurance?

Vacation home insurance covers a home you own but is not your primary residence.The key here is you cannot cover your vacation home with your primary home insurance policy.

There are implicit risks with a second residence that vacation home insurance coverage addresses, like the fact that the property isn’t inhabited the majority of the year. That’s why you need a specialized vacation home insurance policy rather than a traditional homeowners insurance policy.

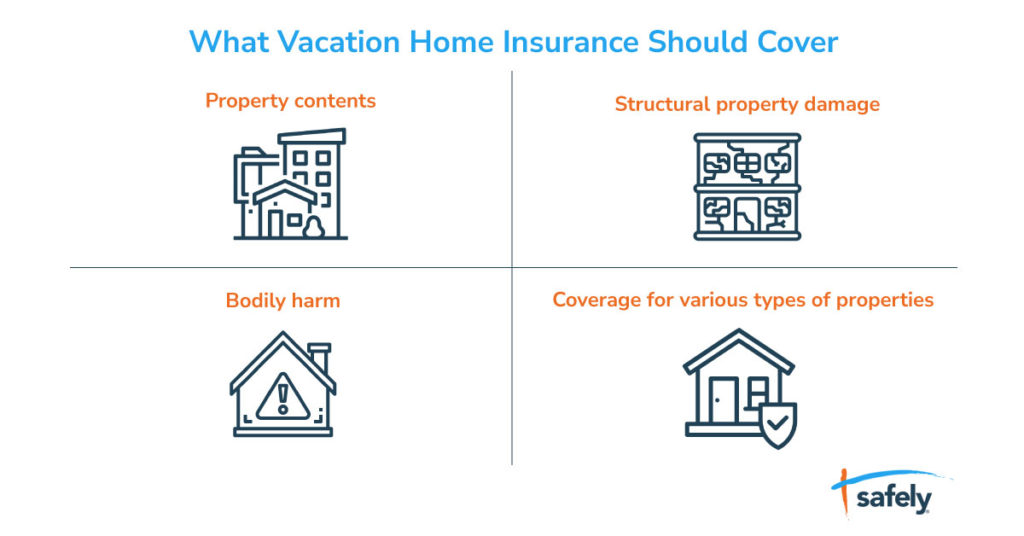

However, you need your vacation home insurance to offer the same coverage as traditional homeowners insurance (or more), paying out for structural property damage, damage to the contents of your home, bodily harm, and personal liability.

Is second home insurance more expensive?

Second homes are typically deemed riskier than primary residences, so second home insurance can be more expensive than traditional homeowners insurance. However, the price of vacation home insurance premiums depends on a number of factors, including the location of your home, the type of property, the age and condition of the home, and the company you purchase your insurance through.

|

Tip: Depending on where your vacation home is located, you may also need to purchase additional coverage, such as flood insurance. |

Why are second homes deemed riskier than primary residences?

Insurance companies see second homes as being more precarious than primary residences, as there are more possible threats to a property without a permanent resident. Because you don’t live there full-time, there’s an increased chance of burglary, vandalism, fires, and flooding.

This higher level of risk is why vacation home insurance costs tend to be higher than those of primary residences. Plus, many people list their second homes as short-term vacation rentals, which adds an extra level of risk, since they operate as a business and have a range of different residents.

What factors go into building a vacation rental insurance quote?

A number of factors have an impact on a vacation rental insurance quote. One of the most important variables is location. Take a look at the average secondary home insurance rates across different US states:

|

Average annual premium for $250,000 dwelling coverage (according to Bankrate.com) |

|

| Short-term rental insurance in Alabama | $2,524 |

| Short-term rental insurance in Alaska | $1,825 |

| Short-term rental insurance in Arizona | $1,735 |

| Short-term rental insurance in Arkansas | $3,582 |

| Short-term rental insurance in California | $1,461 |

| Short-term rental insurance in Colorado | $2,230 |

| Short-term rental insurance in Connecticut | $1,796 |

| Short-term rental insurance in Delaware | $1,106 |

| Short-term rental insurance in Florida | $2,262 |

| Short-term rental insurance in Georgia | $2,091 |

| Short-term rental insurance in Hawaii | $697 |

| Short-term rental insurance in Idaho | $1,271 |

| Short-term rental insurance in Illinois | $1,858 |

| Short-term rental insurance in Indiana | $1,578 |

| Short-term rental insurance in Iowa | $2,006 |

| Short-term rental insurance in Kansas | $4,281 |

| Short-term rental insurance in Kentucky | $2,872 |

| Short-term rental insurance in Louisiana | $3,184 |

| Short-term rental insurance in Maine | $1,485 |

| Short-term rental insurance in Maryland | $1,740 |

| Short-term rental insurance in Massachusetts | $1,865 |

| Short-term rental insurance in Michigan | $1,605 |

| Short-term rental insurance in Minnesota | $2,416 |

| Short-term rental insurance in Mississippi | $3,235 |

| Short-term rental insurance in Missouri | $2,302 |

| Short-term rental insurance in Montana | $2,669 |

| Short-term rental insurance in Nebraska | $4,189 |

| Short-term rental insurance in Nevada | $1,371 |

| Short-term rental insurance in New Hampshire | $1,147 |

| Short-term rental insurance in New Jersey | $1,128 |

| Short-term rental insurance in New Mexico | $3,275 |

| Short-term rental insurance in New York | $1,470 |

| Short-term rental insurance in North Carolina | $1,603 |

| Short-term rental insurance in North Dakota | $2,694 |

| Short-term rental insurance in Ohio | $1,895 |

| Short-term rental insurance in Oklahoma | $5,390 |

| Short-term rental insurance in Oregon | $1,096 |

| Short-term rental insurance in Pennsylvania | $1,217 |

| Short-term rental insurance in Rhode Island | $1,944 |

| Short-term rental insurance in South Carolina | $1,840 |

| Short-term rental insurance in South Dakota | $3,038 |

| Short-term rental insurance in Tennessee | $2,736 |

| Short-term rental insurance in Texas | $3,143 |

| Short-term rental insurance in Utah | $975 |

| Short-term rental insurance in Vermont | $1,020 |

| Short-term rental insurance in Virginia | $1,557 |

| Short-term rental insurance in Washington | $1,306 |

| Short-term rental insurance in Washington, D.C. | $1,620 |

| Short-term rental insurance in West Virginia | $1,813 |

| Short-term rental insurance in Wisconsin | $1,368 |

| Short-term rental insurance in Wyoming | $1,274 |

For example, compare short-term rental insurance in Florida with short-term rental insurance in California: There’s a difference of over $800 between the two. And if your property is located somewhere more susceptible to natural disasters or weather damage, like hurricanes, tornadoes, wildfires, or flooding, this will be reflected in your insurance quote.

Other factors that go into building a vacation home insurance quote include the age and state of the home, as well as the type of property. So an apartment that was built last year won’t get the same quote as a decade-old beach house, even if they’re located a block away from each other.

Does a homeowners insurance policy cover a second home?

Many insurers require you to get a separate insurance policy if you own a vacation property: It’s rare to be able to use the same homeowners insurance policy for both your primary and secondary residence.

Plus, many insurance companies won’t cover you if you use your second home for commercial purposes, like offering it as a short-term vacation rental. That’s why it’s so important to work with a company that specializes in short-term rental insurance, like Safely, to cover your second home.

However, the property insurance policy you get for your second home will cover a lot of the same things as your primary home insurance, including damage to the interior and exterior of your house, damage to the contents of your home, and personal liability for damage you unwillingly cause to others or their property.

How to choose between different second home insurance policies

When choosing between different second home insurance policies, the first thing you should ask yourself is what you plan to use your property for. Even if you’re just going to be using it as a seasonal home for your family, explore coverage options before deciding on a policy, and take into account the different areas of risk.

For example, if you have a beach house, you will need a policy that accounts for water damage and natural disasters, while someone with a peaceful getaway in the country has less demanding coverage needs.

But if you plan on renting your second home out as an Airbnb or vacation rental, you need a policy that covers your property when it’s being used for commercial purposes. With Safely, you get coverage for:

- Property contents (up to $10,000)

- Structural property damage (up to $1,000,000)

- Bodily harm (up to $1,000,000)

Also, Safely provides automated guest screening along with our insurance. So when you purchase our comprehensive vacation rental insurance, you know your guests will also receive a non-intrusive background check to protect you from high-risk guests.

|

Did you know? Safely offers coverage for all types of properties, including apartments, cabins, duplexes, and cottages. No matter what type of property you own, there are coverage options for you. |

Get the best insurance coverage for your vacation home

Depending on where your second home is located, what kind of shape it’s in, and what you plan on using it for, you may be looking at very different second home insurance policies. Keep all these factors in mind when deciding on the type of coverage you want and what company you want to trust your vacation home insurance with.

If you plan on renting out your vacation home, and are looking for the best short-term rental insurance, Safely has you covered. Our comprehensive short-term rental insurance policies include ID verification and guest screening, and protect owners, property managers, and guests.

Protect your business from costly damages with Safely’s short-term rental insurance.

Frequently asked questions

What’s the difference between a vacation home and a second home?

A second home and a vacation home are essentially the same: A property you occupy less than your primary residence. However, an investment property is a property you plan on renting out to earn money, even if you also use it as a vacation home.

What is secondary residence coverage?

Secondary residence coverage is homeowners insurance for a property that is not your primary residence. Secondary residence coverage encompasses the same benefits as primary residence coverage, like damage to your home and personal property coverage. But it often comes at a different price tag given the implicit risks having an unoccupied residence entails.

What is liability coverage?

Liability coverage helps pay for expenses related to bodily harm incurred on your property. This can include medical bills, pain and suffering, and lost wages.

It’s especially important for short-term rental owners and property managers to make sure their properties have liability coverage in the case of a guest getting injured on their property.

How do you insure a vacation home?

To insure a vacation home, you should get a specialized policy for secondary residences. And if you also plan on renting out your vacation home, be sure to get a policy that covers you in the event of guests damaging your property, its contents, or themselves during their stay.

Can I combine two homes under a single policy?

In most cases, you will need to get a separate insurance policy for two different homes. This is especially true if your second home is a rental property, as a traditional homeowners insurance policy won’t normally cover a property that generates an income.

How do you save money on a second home insurance policy?

To save money on a second home insurance policy, you should shop around different companies to compare insurance rates and coverage options. But at the end of the day, a home insurance quote is about more than the premiums and deductibles: Take into account how much money that policy will save you in the event of an accident at your second home, the claims process, and if it includes automated guest screening.