If you’re considering becoming an Airbnb host, congratulations! You’re about to embark on an exciting, financially rewarding journey. But starting out on a new platform like Airbnb can be daunting, especially when it comes to understanding how payouts work. In this article, we look at everything you need to know about Airbnb payouts, from setting up your payment methods to receiving your earnings.

How do Airbnb Host Payouts Work?

As the world’s best-known online marketplace for listing and booking vacation rentals, boasting an impressive six million listings in 2022[efn_note]iPropertyManagement, Airbnb Statistics six million listings in 2022 https://ipropertymanagement.com/research/airbnb-statistics[/efn_note], Airbnb is the global go-to platform for renting out a space or finding a place to stay. And with good reason! With a focus on ease of payment, Airbnb has designed a 5-step approach that makes it as easy and secure as possible for both hosts and guests.

Let’s take a closer look at how the system works:

Step 1: Host Selects Payout Method

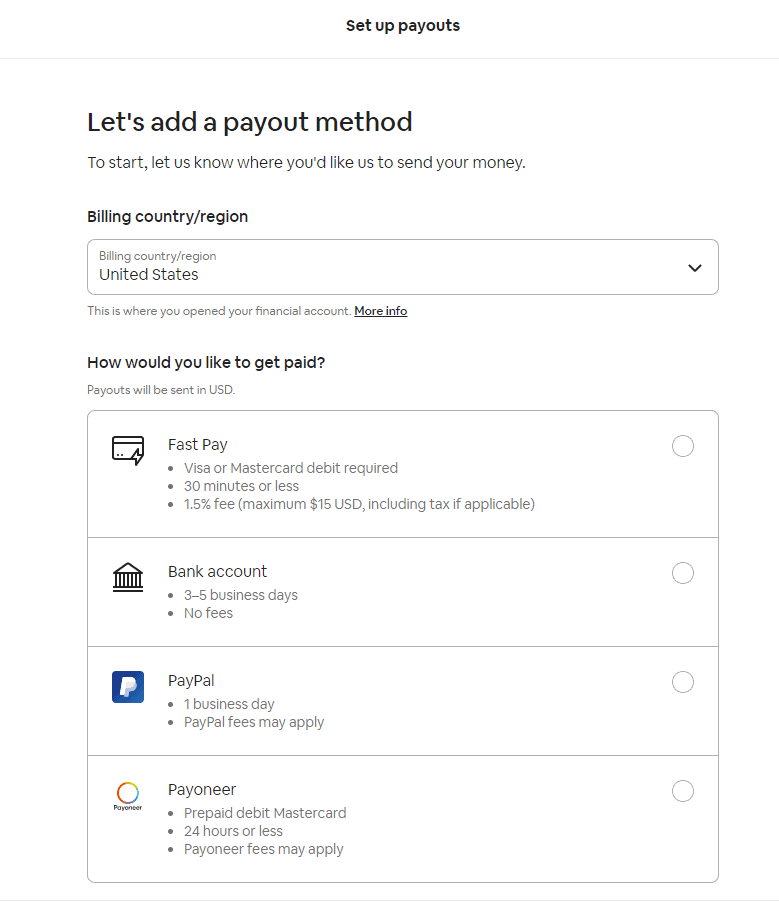

As a new host, you first need to set up a payout method for your account. You’ll select your payout currency, which is based on your country, and then select a method for payment. Once you’ve added a payout method, you won’t be able to change its currency. However, you can always set up a new payout method in a different currency as needed. This process may take some time, so it’s best to get started as soon as possible.

Types of Airbnb Payout Methods

Airbnb provides hosts with six different options for receiving payments. You can choose to use one or multiple methods and even split your payouts among them using routing rules. Here’s an overview of each method:

- Fast Pay: If available in your country or region, this method lets you receive payouts to an eligible Visa or Mastercard debit or reloadable prepaid card issued in the US.

- Bank account: To use this method, simply enter your bank routing number and account number. You’ll need to wait for a small deposit to verify that your account is ready. “For Further Credit” accounts (FFC) are not eligible for direct deposit.

- PayPal: Before adding PayPal as a payout method, make sure your account is activated.

- Payoneer PrePaid Debit Mastercard: To use this method, enter your name as it appears on your official ID. Payoneer will need to approve your details before you can start receiving payouts.

- International wire: Depending on your location, you may need to enter your account number or IBAN. These details can be obtained from your bank. Fees may apply.

- Western Union: To use this method, enter your name as it appears on your official ID. Fees apply.

How to Add a Payout Method on Airbnb

To set up a payout method on Airbnb, follow these steps:

- First, go to your Account and select “Payments & Payouts” from the menu, then click on “Payouts.”

- If you haven’t set up a payout method before, click “set up payouts.” If you already have an existing payout method, you can add a new one by clicking “Add payout method.”

- Select your billing country or region to view the available payout methods.

- Choose the payout method you want to use and click “Continue.”

- Enter the required information and click “Next.”

- If you have set up multiple payout methods, you can choose a default option.

By following these steps, you can easily set up your payout method and start receiving payments from your Airbnb bookings.

You’ll find additional information on the Airbnb website[efn_note]Airbnb Help Center, Adding a payout method https://www.airbnb.com/help/article/54[/efn_note].

What’s the Best Payout Method for Airbnb?

As an Airbnb host, you have the freedom to choose the payment method or methods that work best for you. You can adjust your payment preferences whenever your needs change. However, certain money transfer service options may not be available in some regions. In such cases, hosts should consider being open to debit or credit card payments.

Step 2: Guest Pays Airbnb When They Book Accommodation

When a guest submits a reservation request, their payment information is collected by Airbnb. Once you accept the reservation request, Airbnb will charge the guest’s nominated payment method for the entire amount at that time.

Step 3: Airbnb Calculates the Payout (Including Service Fees)

To calculate your payout amount, Airbnb takes into account various guest charges and deducts applicable Airbnb fees. Airbnb will also collect the necessary taxes based on the area where you’re conducting your business. This ensures that you receive the correct amount[efn_note]Airbnb Help Center, Calculating your payout https://www.airbnb.com/help/article/459/[/efn_note] for the rental and that all taxes are accounted for.

Step 4: Airbnb Pays Out Money to the Host

Once the guests have checked in, hosts can expect to receive payment within one to two days. However, if guests are staying in the rental for more than 28 nights, hosts will receive payment monthly. If you’re a new host on Airbnb and receive your first reservation, please note that it may take Airbnb up to 30 days to process your payment. If you have set a minimum payout amount, your payout won’t be released until that amount is met. In the event that you have multiple listings with check-ins on the same day, any funds going to the same payout method will be deposited as a single payout. To keep track of the payout status, hosts can check their transaction history[efn_note]A Guide To Payments And Payouts, Airbnb https://www.airbnb.co.in/d/prohosthospitalityhub-es-pagos-y-cobros[/efn_note] to see which payments are pending and received. This feature allows hosts to stay on top of their earnings and ensure that they’re receiving payment for all completed reservations.

How Stay Lengths Impact the Airbnb Payout Process

When timing your Airbnb payout, it’s important to consider how the length of the stay affects this process. Payments for short-term stays will be processed differently compared to payouts for long-term stays. For this reason, you should expect variations in the time it takes to receive payments.

Short-Term Stays

When does Airbnb payout on short-term stays? Any stay that consists of 27 nights or less is a short-term stay under Airbnb’s terms of service. These short-term stay payouts go through the processing system 24 hours after the completion of the guest’s check-in.

From there, the payment platform you use (PayPal, Fast Pay, bank account, etc.) will determine how quickly you receive the money. When there’s a delay, it’s often the result of the time it takes the payment service to run through the procedure. For example, a wire transfer can take several days after Airbnb processes the funds.

Long-Term Stays

You might drop your off-season rental rates to encourage longer stays. When guests stay for 28 nights or longer, your first Airbnb payment will go through processing 24 hours after guest check-in. This is the same procedure used for short-term rentals.However, the process differs in that a long-term stay initiates recurring monthly payments. All of the consecutive payouts from Airbnb will go through processing on a monthly basis following that first payment. This process also relies on the speed at which the payment platform transfers the funds.

When Do Airbnb Hosts Get Paid?

After Airbnb releases your payout, it undergoes processing before being delivered to your payment provider. Due to this additional processing time, the money could be delayed in arriving in your account.

Here are the estimated processing times for each payout method:

- Fast Pay: 30 minutes or less once Airbnb releases the payout (available for US only)

- Bank account: 3-5 business days

- PayPal: Within 1 business day

- Payoneer Prepaid Debit Mastercard: Within 24 hours

- International wire: 3-7 business days

- Western Union: 1 business day, depending on the country or region

Banking systems don’t process transactions on weekends or holidays. This means that your payout may not be processed until the next business day. However, Fast Pay and Payoneer allow payouts to be processed and sent on weekends and holidays. If you use these payout methods, you may receive your payment faster than with other methods.

It’s important to keep these processing times[efn_note]Airbnb Help Center, When you’ll get your payout https://www.airbnb.co.in/help/article/425[/efn_note] in mind when planning your finances as a host. You can always check the status of your payouts within your account’s transaction history on the Airbnb website.

Understanding Airbnb Payout Delays

Once you have established yourself as a host, you should receive payouts on a consistent schedule. However, there are some situations in which you could experience short payment delays.

New Host Payment Delays

An important part of understanding the Airbnb payout process is recognizing that some delays are unavoidable. As a new host, your payments will be delayed for 30 days. The 30-day delay begins upon confirming your first reservation.

If the guest makes their reservation more than 30 days in advance, this period counts toward the new host delay. In this situation, the guest’s payment goes through the normal 24-hour processing procedure.

Incorrect Payout Settings

For your convenience, Airbnb lets you set up payment methods and processes to meet your needs. These options include setting automatic payouts and minimum payout amounts. If you don’t have your dashboard set for automatic payments, you will have to request each payment manually.

In using a minimum payout amount, you’ll set the minimum amount for payments to go through processing. For example, you might put your minimum at $1,000. In this case, you won’t receive a payment until you have reached that $1,000 goal.

Holiday and Weekend Delays

Beyond special circumstances, you might experience a delay when banking institutions close for short periods. Federal holidays and weekends commonly cause disruptions to the payment process. Highlight holidays on your calendar to ensure you account for these delays in advance.

How Does the Airbnb Co-host Payout Method Work?

As a primary host, you have the option to add a co-host[efn_note]Airbnb Help Center, How Co-Hosting works https://www.airbnb.com/help/article/3153[/efn_note] to your listing to assist with various tasks, such as responding to inquiries or meeting new guests. It’s also very easy to pay your co-host via the Airbnb payment system as you can select the split-payment option under the “routing rules” section within your payment method dropdown. Once you enter the required information, your co-host can receive a payment.

How do Airbnb Aircover Payouts Work?

Airbnb’s Host Damage Protection is part of their free policy for Hosts called AirCover, which promises to provide up to $3,000,000 in compensation for property-related damages.

If damage occurs during a guest’s stay, hosts can follow these steps to get reimbursed:

- Gather evidence of the damage, such as photos, videos, estimates for repairs or cleaning, and/or receipts.

- Within 14 days of the guest’s checkout, file an AirCover for Hosts request through Airbnb’s Resolution Center.

- After submitting the AirCover for Hosts request, the guest will have 24 hours to pay. If they decline to pay the full amount or don’t respond, Airbnb Support can get involved.

Guests are made aware at the time of booking that their payment method may be charged if damage is done to the property. However, AirCover should not be solely depended upon as your only means of remedy, as it has considerable limitations when compared to specialist rental insurance companies such as Safely.

As the short-term rental market continues to flourish, becoming a Host is an exciting and rewarding experience and a great source of additional revenue. Being a successful host means not only creating a great guest experience but also knowing how to make it work for you. Understanding how Airbnb payouts work is a fundamental part of this, as is protecting your property investments. Getting the right insurance that works with you to maximize your profit potential and that offers rigorous guest screening will ensure your business thrives without fear of liability and stress of unexpected costs (Check out our detailed article on the best insurance options for airbnb hosts). As the leading provider of short-term rental protection, Safely offers guest screening and affordable, comprehensive rental coverage on a per-night basis.

Protect Your Vacation Rentals for a Higher ROI

While timing the payouts you get from Airbnb will help you maintain a steady flow of revenue, property maintenance will negatively impact your overall returns. Safely offers guest screening and vacation rental insurance to minimize your upkeep costs. Contact us to find out how our services can reduce expenses and safeguard your property.

Your Property, Your Business, Your Guests – Protected.

With Safely’s Short-Term Rental Insurance

Related Resources